CONSUMER PERCEIVED RISK IN CAR PURCHASE

K. Rajendran1and J. Jayakrishnan2

1Department of Management Studies, E.S. Engineering College, India

2Department of Business Administration, Annamalai University, India

10.21917/ijms.2018.0100

Abstract

This paper presents a study on consumer perceived risk towards their purchase decision to buy automobiles in India, having knowledge of various aspects of consumer buying process can help companies significantly when developing strategies to increase their market share, while relying on two mechanism: enhancing the customer satisfaction or reducing the customer perceived risk and also this paper aims to develop the empirically test a conceptual model of consumer perceived risk for car purchase. It mentions results from regression analysis which revealed positive link between the said factors with purchase decision. It also provides a platform for automobile manufactures to understand consumer behaviour and it is impact on their decision to purchase.

Keywords:Consumer Behaviour, Perceived Risk, Automobile, Purchase Decision and Model of Consumer Behaviour

1. INTRODUCTION

Consumer behaviour is study with the individuals, groups or organizations and they use to select and dispose the services, products and experience or ideas to satisfy their needs and impacts of process in the consumers and society. The consumer behaviour consist elements are psychological, sociology, social anthropology, economics and marketing. It understand the decision making process of buyers or customers, both group and individually in analyse the emotion affect consumer behaviour. In this studies explain the characteristics of individual customers such as demographic variables in try to understand the consumer’s needs. It also try to analyses the influences of consumers group such as friends, family, reference groups, sports and society. Consumer behaviour is the activities people undertake when obtaining, consuming and disposing of products and services [1].

The importance of understanding consumer buying behaviour and the ways how the how the customer choice their products and services can be extremely important for manufactures as well as service providers as this provides them with competitive advantage over its competitor in several aspects. For example, they may use the knowledge obtained through studying the consumer buying behaviour to set their strategies towards offering the right products and service to the right audience of reflecting their needs and wants effectively [2].

1.1 CONSUMER DECISION MAKING

A decision making is the selection of an option from two or more alternative choices. A person while make a decision to have a choice of alternatives must be available, When a person has to select the choice between purchase a product and not purchase a product, the choice between product or brand A and B, that person is in a position to take a decision, If the consumer has no alternative choices from which to choose and is little bit forced to select a particular product purchase or services, then this single there was no-choice instance does not constitute a decision, such a no-choice decision is commonly referred to as a Hobson’s choice [3].

According to Koran a purchase decision included the risk when the consequence connected with the decision is uncertain and some result is more desirable than. The consumer decision making process model is represented in three major components Input, Process and Output [4]

1.2 PERCEIVED RISK

Schiffman and Karuk [12] Stated that Consumers have a number of enduring perceptions or images that are is particularly relevant to the study of consumer behaviour [11]. Product and brand have symbolic value for individuals who evaluate them on the basis of their congruence with their personal pictures of themselves. Consumers attempt to preserve or enhance their self-images by buying products and patronizing service that they believe congruent with their self-images and by avoiding those that are not [5].

Perceived risk usually plays an impotent role in the purchase decision making process regardless of the nature of the purchase occasion (planned vs. impulse). Every purchase contains some degree of risk [6].

1.3 THE IMPACT OF PERCEIVED RISK

In a purchase decision the customers tries to recognize their buying goals and they equalize these goals with product offerings. Perceived risk can be attributed to any one or a combination of the certain factors [7].For example, consumer may be uncertain as to what their buying goals are. Failure to identify buying goals may be the effect of uncertainty about, the nature of goals, goal acceptance level or level of aspiration, the relative importance of achieving the goal, current degree of goal attainment that is consumer may vary in their certainty concerning the extent of the difference between their current state and their desired goal acceptance level [8].

The consumer may be uncertain as to which purchase (Place, Product, Brand, model, Style, Size, Color, etc.) will best match or satisfy acceptance level of buying goals. The customer may perceive possible adverse consequences if the purchase is made and the result is a failure to satisfy the buying goals [9].

1.4 CIRCUMSTANCE THAT ACCENTUATE PERCEIVED RISK

Perceived risk [10] can be associated with any product or service, but it tends to be higher in the following circumstance:

- Little information is available about the offering.

- The offering in new

- The offering has a high price

- The offering is technologically complex.

- Brands different substantially in quality, so the consumer might make an inferior chaise

- The consumer has little confidence or experience in evaluating the offering.

- The opinion of other is impotent, and the consumer is likely to be judged on the basis of acquisition, usage, or disposition decision

1.4.1 Perceived Risk has a Function of Three Dimensions:

- The probability that the innovation will not perform as desired.

- The consequence of it not performing as desired.

- The ability to reverse and the cost of reversing, any negative consequences.

1.5 TYPES OF PERCEIVED RISK

- Functional risk - is the risk that the product will not perform as expected

- Physical (or Safety) risk - is the risk to self and other that the product may pose. It refers to the potential harm a product or service might pose to one’s safety.

- Financial risk - is the risk that the product will not be worth its cost.

- Social risk - is the risk that a poor product choice may result in social embarrassment. It is the potential harm to one’s social standing that may arise from buying, using, or disposing of an offering.

- Psychological risk - is the risk that a poor product choice will bruise the consumer’s ego. It reflects consumers’ concern about the extent to which a product or service fits with the way they perceived themselves.

- Time risk - is the risk that the time spent in product search may be wasted if the product does not perform as expected, it reflects uncertainties over the length of time that must be inverted in buying using, or disposing of the product or service

- Decision risk - buying a product will result in additional purchase of other goods

- Obsolescence risk - the risk the product will soon become obsolescent

- Facility risk - has been introduced in the study. This risk is peculiar to developing countries like India where often the lack of facilities will hamper people from buying a car. Lack of availability of garage at home, poor parking facilities at work spot and extremely congested roads with a high density of two wheelers will often dissuade people from buying a car.

1.6 CAR MARKET IN INDIA

Since 1991, India has moved to being a market that for most multi-national companies is inevitable. Indian’s crusade to remodel into a global manufacturing hub has received an enthusiastic response from automakers hailing from driver’s locations and hues. Data for calendar year 2017 decide that vehicle production grew by 42.69% over vehicles, the same period the previous year with production of around 1,70,76,659 vehicles.

The automotive industry in India is one of the largest in the world with an annual production of 23.37 million vehicles in FY 2016-17, following a growth of 8.68% over the last year. The automobile industry accounts for 7.1% of the country's gross domestic product (GDP). The Two Wheelers segment, with 81% market share, is the leader of the Indian Automobile market, owing to a growing middle class and a young population.

1.7 MARKET SIZE

The auto industry produced a total 19.84 million vehicles in April - January 2016, including passenger vehicles, commercial vehicles, three wheelers and two wheelers, as against 19.64 million in April - January 2015. Domestic sales of Passenger Vehicles grew by 8.13% in April - January 2016 over the same period last year. Within the Passenger Vehicles, Passenger Cars rose by 10.18%, during April - January 2016 over April - January 2015.

1.8 RESEARCH PROBLEM

India is one of the country to have lowest car density (estimated at 13 car per 1000 people), when compared to china (45), Brazil (160) and Indonesia (42) .This provides an ideal platform for car manufactures to analyses in perceived risk among the customers in the purchase of car, Because the uncertainty that make the customer feels on the personal consequences of buying or disposing of a car.

However, unless customer reaches the situation where he feels the risk perception is low, it is difficult for a prospective buyer to become a buyer. Car being a costly purchase the customer has a number of unanswered questions which create an uncertainty in the minds of the customer and in turn hinder the person from making an effort to buy a car.

This uncertainty has to be studied in all angles to throw light on what the customer preened as the unknown which in reality can or cannot be a real contributor of risk. The study attempts to take a look into the different risk perceptions and makes an attempt to identify the various risk reduction factors that are relevant in handling the different components of risk.

1.9 NEED FOR THE STUDY

Perceived risk as a study has been carried across a wide range of product and service at a global level. However no study has focused on the different aspects of risk that customer foresee in their purchase of car for data to day use. On an Indian context there are not many works on perceived risk and so far there is on work concerning perceived risk in car purchase focused on the idiom buyer. The Indian domestic car market is peculiar as the market has just started to evolve with cars getting affordable to the common mania study on perceived risk in car purchase in India is highly relevant as the car density is increasing rapidly in the past few years.

A perceived risk involved to be a major factor in the purchase of decision making process by customer. Hence, this study tries to explain the various factors that can cause perceived risk while purchase the car and tries an attempt to find out the influences of risk reduction factors, which can further be used by manufactures and dealers of cars. The study focuses on related aspects such as uniqueness of personality, perceived service, brand rezones and product involvement which all can have an impact an impact on the risk perceived by customers.

1.10 RESEARCH FRAMEWORK

1.11 OBJECTIVES OF THE STUDY

- To examine the consumers perception towards functional risk, financial risk, psychological risk, physical risk, time risk, social risk, obsolescence risk, facility risk, and decision making risk on the purchase of car.

- To know the consumers difference of opinion towards dimensions of perceived risk based on their demographic profile.

- To know the consumers perceived risk based on their uniqueness personality.

2. REVIEW OF LITERATURE

Literature review in a research study accomplishes several purposes. It shares with the researcher the results of other studies that are closely related to the study undertaken. It informs the investigator about the ongoing development in the literature about a study, helps filling in the gap and extending previous studies.

Disabled consumers confined to wheelchairs as they represented a special consumer group for clothing manufacturers and retailers, They have special clothing needs and perceive different risks associated with clothing purchases than do able-bodied consumers [2].

The history of an individual might affect risk perception. Average experienced outcomes could be related to a specific type of situation or the general average outcome of past decision [3].

Psychological risk negatively affects the perceived value of the product, but did not directly influence purchase intentions and store image dimension affected purchase intention indirectly and positively, by reducing risk perceptions. Store quality reduced perceived financial risk, while store atmosphere reduce psychological risk [8].

Obsolescence risk is the risk that the purchased product would quickly become outdated, usually being superseded by an advanced version. Relievers included offering free or low cast upgrade making later version of hardware compatible with the earlier version on hardware, leasing the product for a limited time and only making infrequent but major product changes rather than frequent but minor product alternatives [6].

Car companies while planning their advertisement campaigns should find out the needs of consumer, identify its target group and bring out its distinctive competitiveness so as to reduce the perceived risk associated in the purchase of car [1].

Product attribute played a very important role in marketing from the perspective of the marketer and consumer and it had long been recognized as an opportunity to set the marketer’s brand apart from competition. Consumer also value attributes since they are used as the basis for evaluating a product. Attributes also provide the benefits consumers seek for purchasing a product. This study revealed a positive correlation between product attribute and consumer purchase decision. Consumer purchase decision is viewed as a process in which consumers evaluate alternative products on the strength of various attributes and on the basis of which marketers differentiate and set their brand apart from competition [13].

Enduring involvement as a consumer’s long term and continuous interest in a brand or product category. Personal relevancy resides in the product itself and the inherent ratification that consumption or use brings to a consumer [2].

3. RESEARCH METHODOLOGY

This research has made an attempt to analyse the consumers’ opinion towards dimension of perceived risk and its effect on the car purchase.

3.1 TYPE OF RESEARCH

This research aimed to analysis the perceived risk level of consumer in car purchase. Hence, descriptive study is adopted for this study. It is a fact finding investigation with adequate interpretation. It focuses on particular aspect or dimension of the problem studied. It is designed to gather descriptive information and provided information for formulating more sophisticated studies. This research type allowed collecting primary data by direct interviewing through constructed questionnaire. The collection of data increase awareness of the relative accuracy of the measuring devices and enhances the ability to accumulate further knowledge.

3.2 VARIABLES CONSIDERED FOR THIS STUDY

Based on the literature reviews, the researcher identified the various factors influencing perceived risk in customers. There are factors like personality, brand, product attributes, purchase involvement, perceived service, uniqueness, risk relievers and demographic profile. These factors are considered as independent variables and the perceived risk as dependent variable.

3.3 PILOT STUDY

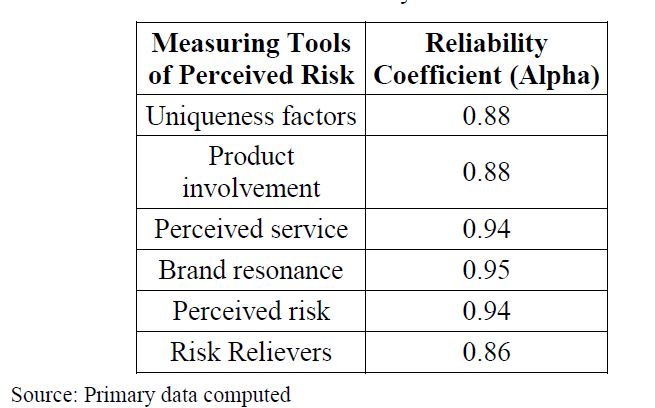

The pilot survey is an essential part of every research study and the pilot study was carried out fifty samples respondents. The sample respondents are selected based on convenience sampling method. After collecting the data, the reliability test is applied the reliability result in presented in Table.1, which start to the survey a pre-test was carried out with 50 respondents the reliability of the tool was checked Cronbach Alpha value.

From the Table.1, it is found that Alpha value is ranged from 0.88 to 0.95. If the values are more than 0.80, the tools are having reliable to study the sample respondents. Hence, the instruments have sufficient reliable value.

4. ANALYSIS AND DISCUSSION

This chapter explained the methodology adopted for this study and this chapter, the researcher has presented the statistical results for this study variables. Based on the statistical analysis, the interpretations of the study variables are explained.

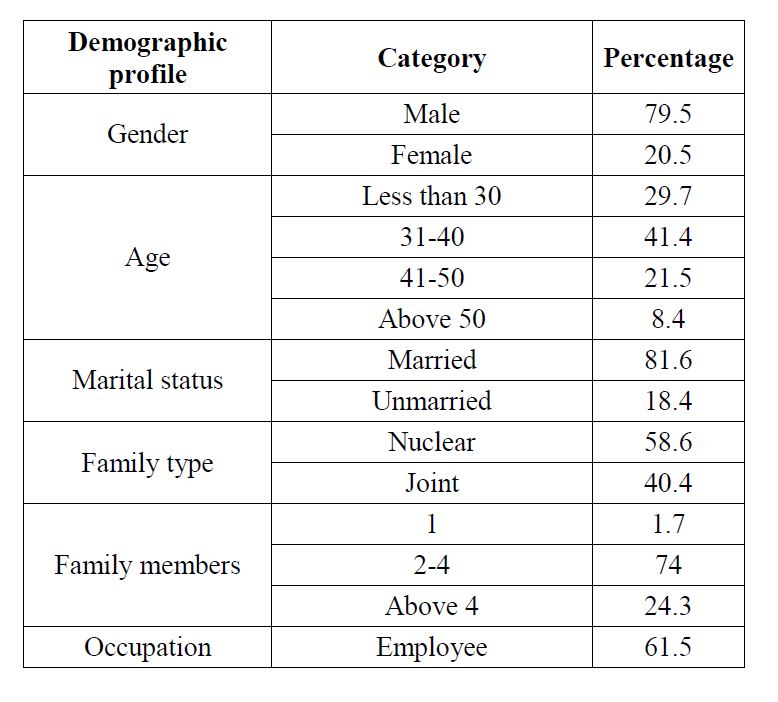

4.1 PROFILE OF THE CUSTOMERS

From the Table.2, it is observed that 79.5% of consumers are male 76 and 20.3% of consumers are female, 29% of cconsumers are have below 30 year of age, 41.4% of consumers are 30-40 age group, 21.5% of consumers are in the 41-50 age group and 8.4% of consumers are in the above 50 age group. Among the consumers 81.6% are married and 18.4% of consumers are unmarried.

- Family type: 58.6% of consumers are belong to nuclear families, 40.4% of consumers are joint family.

- Number of family members: 74% of consumers are having families with 2-4 members and 24.3 consumers are having families with more than 4 members.

- Occupation: 7.9% of consumers are students, 61.5% of consumers are employed and 30.6% of consumers are from businessmen or professionals.

- Intended usage: 30.5% of consumers are use their cars for long outdoor, 29.6% of consumers are used their car for shopping trips, 27.2% of consumers are used their car for going to their work spot and 12.3% of consumers are used for social status.

- Usage distance: 27.2% of consumers are used their car in less than 300 kilometres, 26.8% of consumers prefer to use the car from 301 to 500 kilometres, 26.7% of consumers are used the car from 501 to 1000 Kilometres and 25.1% of consumers are used the car for more than 1000 Kilometres.

- Annual income: 25.6% of consumers are having less than 5 lakhs annual income, 27.2% of consumers are having annual income from Rs. 5,00,001 to 8,00,000 lakhs, 14.4% of consumers are having annual income from Rs.8,00,001-10,00,000 lakhs and 32.6% of consumers are having annual income above Rs. 10,00,000 lakhs.

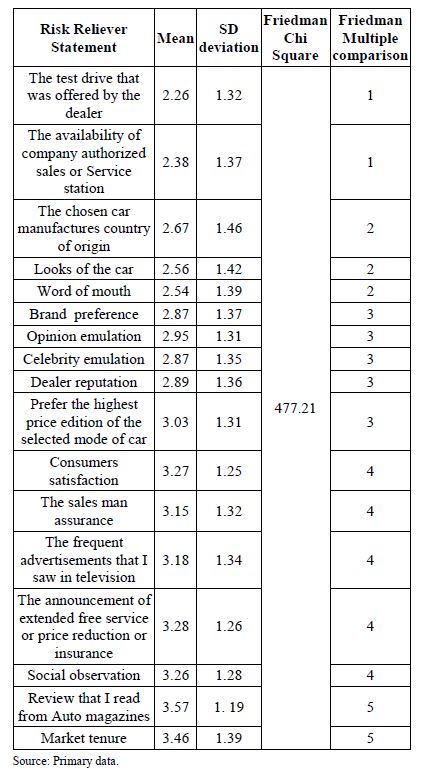

H0: Consumers opinions towards the risk reliving factors are not varied among them self.

In order to examine the above stated hypothesis, Friedman test is applied. The calculated P value is found to be significant. Hence, the stated hypothesis is rejected. It is found that the consumers, perception towards the risk relievers are varied among themselves. Further, Friedman multiple comparison test is applied to find out the important risk relievers.

It is found that to avail the test drive, availability of authorized service outlet most predominant risk reliever. These relievers are placed in the first level of risk relievers.

The second category of risk reliever includes country of origin, looks of the car and word of mouth. The next category of risk reliever was brand preference, celebrity emulation, opinion leadership, choice of high end edition and dealer reputation.

5. FINDINGS AND SUGGESTIONS

It is found that risk relievers reduced perceived risk and that the role of risk reliever is unique in that a certain risk reliever has its impact only on a specific component of perceived risk. Facility risk was less influenced by risk reliever whereas physical risk, psychological risk, functional risk, social risk, financial risk, time risk, decision risk and obsolescence risk were more influence by risk relievers. Risk relievers like test drive, brand preference, availability of service centres as well as unique personality and product involvement were found to influenced a higher number of components of perceived risk.

When consumers have higher feeling of perceived service the dimensions of perceived risk tend to decrease. Companies should enhance the service ambience in order to reduce the perceived risk associated with purchase of car. It is often the cost of owning a car rather than the cost of buying a car that pits away a prospective buyer. The service centre personal should be trained to communication he needed service properly by having proper facilities for customer to wait while the vehicles are being serviced and coming up with a reasonable time schedule when the maintenance can be completed etc.

6. CONCLUSION AND SCOPE FOR FURTHER RESEARCH

This study has ascertained the particular risk that is effective for a certain dimension of perceived risk, this should help the manufactures to make reduce the risk to decrease the perceived risk of the customer below the threshold level and increase the chances to purchase of more car, the government on its part should improve upon infrastructure which will further improve or elaborate the market, the companies should develop marketing communication throughout country that portray the offerings as relevant to consumer needed value and goals.

Further research can be carried out in other suitable area or across the state so as to generalize the risk reliever suitable to reduce the perceived risk. Risk reliever suitable for each brand can be identified so that the perceived risk accompanying each brand can be pinpointed. Perceived risk for luxury cars which is not part of this study can also be studied.

REFERENCES

[1] J. Abramson and S. Desai, “Purchase Involvement of the New Car Buyers: A Descriptive Study”, American Journal of purchase, Vol. 2, No. 8, pp. 13-20, 1993.

[2] George Brooker, “An Assessment of an Expanded Measure of Perceived Risk”, Advances in Consumer Research, Vol. 11, pp. 439-441, 1984.

[3] Ernest R. Cadotte, Robert B. Woodruff and Roger L. Jenkins, “Expectations and Norms in Models of Customer Satisfaction”, Journal of Marketing Research, Vol. 11, pp. 305-314, 1987.

[4] Paul Chao and Pola B. Gupta, “Information Search and Efficient of Consumer Choice of New Cars: Country of Origin Effects”, International Marketing Review, Vol. 12, No. 6, pp. 47-59, 1995.

[5] Wan Ying Chua, Alvin Lee and Saalem Sadeque, “Why do People Buy hybrid Cars”, Proceedings of Social Marketing Forum, pp. 1-13, 2010.

[6] B. Dipayan, B. Abhijit and N. Das N, “The Differential Effects of Celebrity and Expert Endorsement on Consumer Risk Perceptions, Journal of Advertising, Vol. 35, No. 1, pp. 17-31, 2006.

[7] O. Godlevskaja, J.V. Iwaarden and T.V. Wiele, “Moving from Product-based to Service-based Business Strategies”, International Journal of Quality and Reliability Management, Vol. 28, No. 1, pp. 62-94, 2011.

[8] R.Y. Garbarino and E.G. Strahievitz, “Gender Differences in the Perceived Risk of Buying Online and the Effects of Receiving a Site Recommendation”, Journal of Business Research, Vol. 57, No. 7, pp. 768-775, 2004.

[9] William J. Haclena, D.L. Mothersbaught and R.J. Best, “Consumer Behaviour, Building Marketing Strategy”, 10th Edition, McGraw-Hill, 2007.

[10] B. Lowe, “The Relative Influence of Pioneer and follower Price on Reference Price and Value Perceptions”, Journal of Product and Brand Management, Vol. 19, No. 7, pp. 504-511, 2010.

[11] Nayeem Tahmid, “Cultural Influences on Consumer Behaviour”, International Journal of Business and Management, Vol. 7, No. 21, pp. 63-75, 2012.

[12] Leon.G. Schiffman and Leslie Lazer Kanuk, “Consumer Behaviour”, Prentice Hall, 2007.

[13] L.N. Witell and A. Fundin, “Dynamics of Services Attributes: a Test of Kano’s Theory of Attractive Quality”, International Journal of Service Industry Management, Vol. 16, No. 2, pp. 152-168, 2005.