IMPACT OF LOAN CYCLE ON EMPOWERMENT IN MICRO FINANCE

Abhijit Sinha1 T.V. Akhila2 and T. Jyotish3

Department of Commerce, Pondicherry University, India

DOI: 10.21917/ijms.2016.0033

Abstract :

The present study basically analyse the level of empowerment of people especially women in different loan cycle in the SHG loan. The study specifically examined the level of empowerment through microfinance in the region of North Kerala. Prevailing interest rate and repayment period of loan is supportive to the better utilisation of loan and thereby it brings empowerment. SHG members are participating in rural development, sustainable development, agriculture and commercial investment and thereby they are getting empowered. In the present scenario caste system and religious regulations are not supporting the women empowerment. By getting financial support to the poor automatically the whole society will get empowered. Reinvestment, loan system and financial support have significant impact on empowerment. The results of the study reveal that status of empowerment will vary according to the level of loan cycle. Higher loan cycle leads to higher empowerment.

Keywords:

Microfinance, SHG, Loan Cycle, Financial Support and Empowerment

1. INTRODUCTION

Microfinance is a vibrant sector in India. In 1976, Muhammad Yunus the Nobel laureate who found Grameen Bank in Bangladesh, later it led to a rapid growth for microfinance sector. The concept microfinance (MF) has emerged as a weapon to assist the poor people mainly focused on poverty reduction and women empowerment. Simply microfinance is the smaller amount financial services given to the financially backward section of the society. In India Microfinance institutions include NGOs, commercial banks, RRBs, and recently apart from that some large lenders also came forward to the sector. Most of the banks have linkage with SHG to provide credit to the borrowers especially to the poor. Microfinance helps the poor to access efficient provision of savings, credit insurance facilities and it is found to enable better standard of living for the poor. According to Suprabha [10] eradication of poverty is possible only when self-help groups (SHG) are engaged in income generating microenterprises. As opined by Thi Minh-Phuong Ngo & Zaki Wahhaj [21] women by attaining financial strength through SHG have better bargaining power when engaged in investing in autonomous activity. Beatriz Armendáriz de Aghion and Jonathan Morduch [1] observed that majority of the women typically benefit from smaller loans than men. Apart from poverty eradication micro finance (MF) also helps in agriculture which is the major contributor of national income, so MF is highly influencing economic development. To the some extent SHG tries to link the economic recourses and undermined their sustainability mainly because the banking system uses different kinds of tools to attain inclusive innovation and social entrepreneurship in India (Lina Sonne [20]). The present study basically analyse the level of empowerment through loan provided by the SHGs. The study specifically examined the level of empowerment through microfinance in the region of North Kerala. Further the study measures the level of empowerment based on loan cycle, satisfaction towards loan, utilisation of loan, and productivity. In Indian context microfinance is growing rapidly through the important objective of financial inclusion. In practice it could attained only through the micro-credit. Grameen Banks and SHGs are actively participating for the accomplishment of financial inclusion through microfinance. SHGs are mostly engaged for the welfare of women through affordable loans and other programmes. SHG loans help them to engage in agriculture activities micro enterprises. There are a very few studies that empirically support the relationship of loan cycle (Different stages of loan) and empowerment through microfinance. The study basically conducted to boost the performance of microfinance institutions in North Kerala. Thereby the scope of current study is limited to North Kerala. The result emerged from the study will help to create awareness about women entrepreneurship in North Kerala and to give suggestion to local authorities and to inform government to formulate supportive and satisfactory policies regarding women empowerment and microfinance institution’s loan policy etc. The objective of the study is to examine extend of empowerment at various levels of loan cycle and give suggestions for attaining increased level of empowerment. The study also test the satisfaction level of prevailing loan system, to analyse the utilisation and investment of loan amount, to test the influence of micro-credit in the social environment and finally to test the socio-economic impact of microfinance.

2. REVIEW OF LITERATURE

Microfinance is considered as a weapon for poverty alleviation and to get empowerment in developing countries by supporting entrepreneurship. Woodworth [23] opined that microfinance is useful to lift developing economies from the poverty. Microfinance plays a very major role for promoting women entrepreneurships. Olaf & Adnan [22] found that Microfinance has an influence on empowerment of female borrowers. According to World Bank “Empowerment is the process of increasing assets and capabilities of individuals or group to make purposive choices and transform those choices into desired actions and outcomes.” Obviously the intention of microfinance is to bring empowerment. Microfinance may be a substitute to macroeconomic solutions that are frequently used in development programs (Woodworth [23]). Robinson [19] opined that Microfinance programs are aims to provide assistance for poorest section of the society, accordingly microcredit and development programs are framed. There are lot of studies in the literature supporting the casual link between microfinance access and women empowerment. Micro finance is contributing more to the empowerment of women. Reidar, Bert and Roy [18] found that women leadership has more association with larger board, younger firms, a non-commercial legal status and more female clientele and also found that female chief executive officers and female chairman of the board are positively related to MFI. Micro finance helps to boost the investment capacity of women in business. Thi-Minh & Zaki [21] observed that women achieved financial strength through SHG have better bargaining power when they dealing with investing in autonomous activities. Micro finance institutions are providing loans to the women to build their business. Beatriz & Jonathan [1] opined that majority of the women are getting benefits from smaller loans than men.

To measure the level of empowerment, it is beneficial to know the status of the financial assistance provided as a means of micro finance, SHG and Grameen banks are proving loans to women to engage in investment activities. Olaf & Adnan [22] found that women in higher loan cycle were on higher level of empowerment and thereby it is clear that micro finance plays an important role for empowerment. Goetz & Gupta [7], Kabeer [11], Khan & Noreen [12] opined that the way of utilising the loan amount is seen to be a central component of financial empowerment. The borrower should be capable to enable the best way of utilisation and bringing an efficient and adequate return from that by improving the pay back rate. In addition SHG loans considered as the proxy for clients poverty level, Cull et al. [14], Nadolnyak [24], Hremes et al. [14]. Even though loan size is differ across the sectors since large loans is for poor people, just as small loans may be for richest people.

Micro finance has a crucial role in the society; the impact of micro finance is more comparing to other source of assistance to the poor. (Arindam & Pravat [3]) Financial inclusion is possible when it reaches to the poorest section of the society only, thus it is predicted that an all-encompassing micro finance system would build up the process of financial inclusion in India and thereby would promote empowerment of the society, especially women empowerment.

3. DATA AND METHODOLOGY

The major portions of the data have been collected from primary source through structured questionnaire. Sample of three hundred were selected from three districts of North Kerala namely Kannur, Wayanad and Kozhikode. In order to study the factors affecting the empowerment of women entrepreneurs a regression analysis was conducted. In order to understand about the relationship of loan cycle on loan system, financial support, reinvestment social impact and empowerment, multivariate analysis of variance (MANOVA) was estimated. Loan system in the sense, how much loan amount the beneficiaries are getting through the Micro Finance institutions.

Three hundred questionnaires were used for the study and 15 SHGs have been taken as sample from three districts in North Kerala. We considered empowerment as dependent variable and independent variables include loan system, social environment, loan satisfaction, social impact, re-investment and financial support of SHG. Regression estimates were used to predict the relationship between empowerment and independent variables such as loan system, social environment, loan satisfaction, social impact, re-investment and financial support of SHG.

4. RESULTS

Regression analysis was estimated to know the relationship between empowerment and independent variables includes loan system, social environment, loan satisfaction, social impact, re-investment and financial support of SHG and loan cycle.

Model summary table shows that 74.9% of independent variable are able to predict the dependent variable with an adjusted R square 0.749.

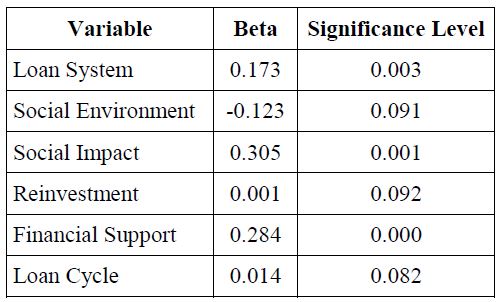

4.1 COEFFICIENTS

The Table.1 shows that, when we are considering loan system 0.173 changes in loan system will lead to 1% change in empowerment. People are getting more empowered by utilising the size of loan amount at prevailing interest rate and repayment period. In their opinion the loan amount is adequate and comparatively less collateral is the attraction of SHG loans. To get 1% change in empowerment there want be 0.305 changes in social impact. Through SHG women are participating in rural development, sustainable development, agriculture and commercial investment and thereby they are getting empowered. With a coefficient of 0.01 changes in reinvestment will lead to a 1 % change in empowerment. By utilising the loan in a productive manner people are getting empowered. Social environment will create a negative impact on empowerment, i.e. -0.123 changes in social environment will lead to 1% change in empowerment. We have considered current caste system and religious regulations as social environment factors. The prevailing caste system and religious regulations are not supporting the women empowerment. So a negative change in the current social environment will lead to increase in empowerment. Further 0.284 changes in the financial support will lead a 1% increase in empowerment. By getting assistance to the poor automatically whole society will empower through better financial support. With a coefficient of 0.014 increases in loan cycle will lead to 1% increase in empowerment. The F test is also significant at one percent showing that the model is fitting well.

So it is clear that for better empowerment we need to increase loan cycle. Reinvestment, loan system and financial support have significant impact on empowerment. In order to increase empowerment people should make better employment of fund. SHG should make the clients to feel financially secured. Social environment is very near to the Empowerment. So the society should liberalize its religious regulation for better empowerment.

In order to understand about the relationship of loan cycle on loan system, financial support, reinvestment social impact and empowerment we have done MANOVA.

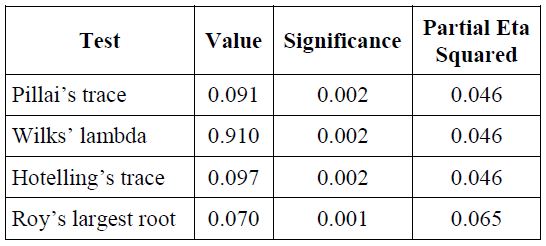

4.2 MULTIVARIATE TEST

BOX’s M test shows a significance of 0.301 suggest that hypothesis of equal variance metrics cannot be rejected so the study can be continued with MANOVA. Bartlett's Test of Sphericity is also significant at 1% level. Descriptive statistics in MANOVA shows that, people belong to all cycle having same opinion about loan system, social impact and empowerment. That is they are agreeing with all of these. Regarding loan system they are satisfied with interest rate, repayment period and loan amount. About financial support they have an opinion that Micro Finance can be considered as a financial (Beatriz [1]) supporter. Because without collateral economically backward people are getting financial assistance. Loan cycle is highly influencing sustainable development, rural development commercial and agriculture development. So about social impact people are showing fair opinion. Benefit through Micro Finance is basically depends up on how much the level of empowerment people got from the financial assistance provided by SHG, that means through the loan. So, standard of living has increased thereby people are getting empowerment in all areas. Regarding reinvestment people in different loan cycle have different opinion. People in first loan cycle is not satisfied, people belongs to second loan cycle shows neutral opinion and people in third cycle have good opinion about the role of Micro Finance in empowerment. Return from the loan amount at first cycle is not adequate for both repayment of loan and reinvestment. People belongs to second loan cycle is having neutral opinion about relationship of empowerment and loan cycle. In the view of people in third cycle, reinvestment is possible with loan amount.

The Table.2 shows significance at 1% level. So we are rejecting the null hypothesis, i.e. there is no relation between empowerment and loan cycle. And we are accepting alternative hypothesis that there is relation between empowerment and loan cycle.

5. CONCLUSION

The study tries to test whether there is any relationship with the empowerment through microfinance and level in loan cycle. The results of the study reveal that status of empowerment will vary according to the level of loan cycle. Higher loan cycle leads to higher empowerment. The reason behind higher empowerment is that they have already repaid the previous loan that they have taken from and this it is clear that they have utilised the loan amount in fruitful way. For getting higher level of empowerment people have to utilise the loan amount in a productive manner by making reinvestment in agriculture, small scale enterprises etc. Through this study we are suggesting the SHG members that, they have to use loan amount for respective purpose and have to develop small micro enterprise with the loan amount. The authority also should monitor the utilisation of loan and should conduct awareness on women empowerment. The government should formulate favourable and liberalised policies towards the functioning of SHG and women empowerment.

REFERENCES

[1] Beatriz Armendáriz de Aghion and Jonathan Morduch “The Economics of Microfinance”, The MIT Press, 2005.

[2] Anushree Sinha, Purna Chandra Parida and Palash Baurah, “The impact of NABARD's Self Help Group- Bank Linkage Programme on Poverty and Empowerment in India”, Contemporary South Asia, Vol. 20, No. 4, pp. 487-510, 2012.

[3] Arindam Laha and Pravat Kumar Kuri, “Measuring the Impact of Microfinance on Women Empowerment: A Cross Country Analysis with Special Reference to India”, International Journal of Public Administration, Vol. 237, No. 7, pp. 397-408, 2014.

[4] Robert Cull, Asli Demirguc Kunt and Jonathan Morduch, “Financial Performance and Outreach: A Global Analysis of Lending Micro Banks”, The Economic Journal, Vol. 117, No. 517, pp. F107-F133, 2007.

[5] Daniel Lazar, P. Natarajan and Malabika Deo, “Micro Finance: Enabling Empowerment”, Vijay Nicole Imprints Private Ltd., 2010.

[6] K. Sivachithappa, “Impact of Micro Finance on Income Generation and Livelihood of Members of Self Help Groups - A Case Study of Mandya District, India”, Procedia - Social and Behavioral Sciences, Vol. 91, pp. 228-240, 2013.

[7] Anne Marie Geotz and Rina Sen Gupta, “Who Takes the Credit, Gender, Power, and Control over Loan use in Rural Credit Programmes in Banglades”, World Development, Vol. 24, No. 1, pp. 45-63, 1996

[8] P. Ghate, “Microfinance in India A State of Sector Report”, Sage Publications, 2007.

[9] Jonas Helth Lonborg and Ole Dahl Rasmussen,“Can Microfinance Reach the Poorest: Evidence”, World Development ,Vol. 64, pp. 460-472, 2014.

[10] K.R. Suprabha, “Empowerment of Self Help Groups (SHGs) towards Microenterprise Development”, Procedia Economics and Finance, Vol. 11, pp. 410-422, 2014.

[11] Naila Kabeer, “Conflicts over Credit: Re-evaluating the Empowerment Potential of Loans to Women in Rural Bangladesh”, World Development, Vol. 29, No. 1, pp. 63-84, 2001.

[12] Rana Ejaz Ali Khan and Sara Noreen, “Micro Finance and Women Empowerment: A Case Study of District Baharpur (Pakistan)”, African Journal of Business Management, Vol. 6, No. 12, pp. 4514-4521, 2012.

[13] Muhammad Nashihin, “Analysis of Potential Demand for Microfinance Services in West-Java by District Areas”, Proceedings of 5th Indonesia International Conference on Innovation, Entrepreneurship, and Small Business, Vol. 115, pp. 91-101, 2014.

[14] Niels Hermes and Robert Lensink, “Impact of Microfinance: A Critical Survey”, Economic and Political Weekly, Vol. 42, No. 6, pp. 462-465, 2007.

[15] D.K. Panda, “Trust, Social Capital, and Intermediation Roles in Microfinance and Microenterprise Development”, International Journal of Voluntary and Nonprofit Organizations, pp. 1-24, 2015.

[16] Philippe Louis and Alex Seret, “Financial Efficiency and Social Impact of Microfinance Institutions Using Self-Organizing Maps”, World Development, Vol. 43, pp. 197-210, 2013.

[17] Ranjula Bali Swain and Fan Yang Wallentin, “Does Microfinance Empower Women? Evidence from Self-help Groups in India”, International Review of Applied Economics, Vol. 23, No. 5, pp. 541-556, 2009.

[18] Reidar Øystein Strøm and B. D’Espallier and R. Mersland, “Female Leadership, Performance, and Governance in Microfinance Institutions”, Journal of Banking & Finance, Vol. 42, pp. 60-75, 2014.

[19] M.S. Robinson, “The Microfinance Revolution: Sustainable Finance for the Poor”, World Bank Publications, 2001.

[20] Lina Sonne, “Innovative Initiatives supporting Inclusive Innovation in India: Social Business Incubation and Micro Venture Capital”, Technological Forecasting and Social Change, Vol. 79, No. 4, pp. 638-647, 2012.

[21] Thi Minh-Phuong Ngo and Zaki Wahhaj, “Microfinance and Gender Empowerment”, Journal of Development Economics, Vol. 99, No. 1, pp. 1-12, 2012.

[22] O. Weber and A. Ahmad, “Empowerment Through Microfinance: The Relation Between Loan Cycle and Level of Empowerment”, World Development, Vol. 62, pp. 75-87, 2014.

[23] Gary M. Waller and Warner Woodworth, “Microcredit as a Grass-Roots Policy for International Development”, Policy Studies Journal, Vol. 29, No. 2, pp. 267-282, 2001.

[24] Valentina Hartarska and Denis Nadolnyak, “An Impact Analysis of Microfinance in Bosnia and Herzegovina”, World Development, Vol. 36, No. 12, pp. 2605-2619, 2008.