FRAMING HYPOTHESIZED MODEL FOR CRM PRACTICES IN BANKS: APPLICATION OF CONFIRMATORY FACTOR ANALYSIS

S. Sheik Abdullah1 R. Manohar2 and M. Manikandan3

Department of Commerce, Ayya Nadar Janaki Ammal College, IndiaDOI: 10.21917/ijms.2016.0035

Abstract :

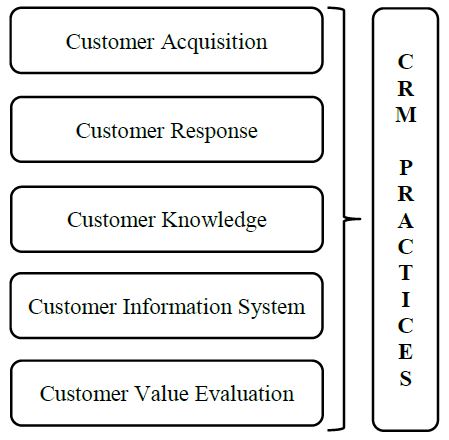

This study has been conducted to frame the hypothesized model of CRM practices in banks. The scale construction consists of 25 statements, under five dimensions such as, Customer Acquisition, Customer Response, Customer Knowledge, Customer Information System and Customer Value Evaluation. In total 175 respondents were selected for this study on the basis of judgment sampling technique. To perceive the high content validity the researcher translates the interview schedule into local language in a printed manner. The factor analysis has been applied to reduce the data. But the factors in each dimension with the cut off score 0.5; the researcher considers all the factors to construct the model and checked it through Confirmatory factor analysis. The input data for CFA is through the output yield by the pattern matrix method of factor analysis in SPSS.

Keywords:

CRM practices, Judgment sampling, Confirmatory Factor Analysis, Customer Opinion, RMSEA.

1. INTRODUCTION

The successful mantra for business is to focus on customer needs, wants and demands. The business is adopting Customer Relationship Management (CRM) strategy is their organizations for the purpose of maintaining long lasting relationship with their customers and to acquire new customer and regain the lapsed customer. The goal of CRM is managing the relationship. The term Customer Relationship Management explained in four words by Hussain et al. [11]

- 1. What to Know: CRM manages the relationship in the longrun.

- 2. Target group: The targeted groups are customers who getproducts and services to satisfy their needs and wants.

- 3. Object: CRM enables the organization to sell theirproducts/services to the targeted group.

- 4. Service: CRM create long-lasting relationship with theircustomer.

Customer Relationship Management (CRM) in the banking sector involves reading the consumers’ changing minds and needs, creating services to satisfy these needs because building and maintaining a relationship with customers in the banking industry is important for the survival. Through CRM, banks manage their services in a manner that persuade customers to use them at a profit thereby ensuring survival and success of the financial institution. Banks can increase their profits by maximizing the profitability through the total customer relationship over the period, instead of seeking to get more profit from any single transaction. In order to survive in the dynamic business environment, relationships from the differentiating factors in view of the similarity of services and this is to say that the quality of relationship differentiates from one bank to another. Therefore, it becomes imperative for service providers to meet or exceed the target customers’ satisfaction with quality of services expected by them. Hence, the researcher has made an attempt frame the hypothesized model of CRM practices in the banks of Virudhunagar District, India.

2. REVIEW OF LITERATURE

In order to identify the research gap, the researcher has made the following reviews to have an insight at the problem.

Bennett [4] described that CRM seeks to establish a long term, committed, trusting and cooperative relationship with customers, characterized by openness, genuine concern for the delivery of high quality services, responsiveness to customer suggestions, fair dealings and willingness to sacrifice short term advantage for long term gains.

Bose [5] described that the customer relationship management (CRM) is essential and vital for a customer oriented marketing and is to gather and accumulate related information about customers in order to provide effective services. CRM involves attainment analysis and use of customer’s knowledge in order to sell goods and services. Reasons for CRM coming to existence are the changes and developments in marketing environment and technology. The same was also mentioned in the work of Nishikant Jha and Shraddha Mayuresh Bhome [15].

Gefen [8] describes the implementation process as an exchange of intangible values. Because there are no specific rules and regulations, against which the success of the CRM implementation can be assessed, as incase with economic exchange, social exchange heavily relies on cooperation and perception of responsiveness of the CRM implementing team.

Gurau, Ranchhold and Hackney [10] argue that technology can be used to define, detailed customer profile based on their value and loyalty. However, proper advantage needs to be taken of the data insight that may require significant changes in organizational processes.

Wang et al. [21] developed an integrative framework for customer value and CRM performance based on the identification of the key dimensions of customer value namely functional value, social value, emotional value and perceived sacrifices. The results found that, customer satisfaction, brand loyalty, functional values have positive effect on customer behavior based on CRM performance where brand loyalty is the most significant influence on customer behavior.

Rootman et al. [16] had undergone a research article on, “Variables influencing the customer relationship management of banks”. He investigated the variables that influence the effectiveness of CRM strategies in banks. These variables were attitude, knowledge ability and two–way communication related to bank employees. Results from this study indicated that attitude and knowledge had influenced the effectiveness of CRM strategies in banks at the 99 percent significant level. This result showed that the relationship between customers and banks are influenced by bank employee’s attitude such as the way they communicate with their customers especially for the bank employees at the front enquiry desk and customer service.

Akroushetal [2] based on the customer relationship management, main dimensions of successful organizational organizing include organizational structure, organizational resources commitment and human resources management commitment. Contacting the individuals is the most difficult stage in customer relationship management process. Internal marketing plays the most important role of customer oriented and customer services delivery in every organization. Internal marketing is resulted from interaction between human resource management and marketing.

Izah Mohd Tahir and Zuliana Zulkifli [12], Firms especially banks have realize the importance of Customer oriented approach and therefore CRM Practices is very crucial part of the banking industry. Thus CRM Practices comprises a framework which includes Customer Acquisition, Customer Response, Customer Knowledge, Customer Information System and Customer value Evaluation. The author conduct the pilot study with reliable and valid instruments tested through Cronbach’s Alpha values ranging from 0.73 to 0.92. That indicates good fit of consistency on the scale.

Sanjay Kanti Das [18], the author argues perception of customers on CRM Practices among banks should also be taken into consideration. The study examines the relationship between customer perceptions on CRM Practices and demographic factors such as gender, age, education level, employment and Modern banking usage. The data collected from 93 respondents out of 100, the result revels that there is no association in mean difference of customer perception on CRM Practices and demographic factors.

Gisela Demo and Kesia Rozzett [9], the study to provide comprehensive way to measure of CRM based on Customer Perspectives to help managers establish profitable relationship. The validated twenty scales item were assessed by the researcher from the work of Rozzett and Demo [9]. Both EFA and CFA conducted, finally the model address the CRM for B2C market in general.

3. STUDY PROBLEM

According to Dilip and Patil [7],Customer is the focal point in the development of successful marketing strategy. Marketing strategies both influence and are influenced by consumers’ affect and cognition, behaviour and environment. In the banking field “a Unique Relationship” exists between the customers and the bank. But because of various reasons and apprehensions like financial burdens, risk of failure, marketing inertia etc., many banks are still following the traditional ways of marketing and only few banks are making attempts to adapt CRM.

As Stated by Ajitab Dash and Soumendra Kumar Patra [1], the efficiency of a banking sector depends upon how best it can deliver services to its targeted customers. In order to survive in this competitive environment and provide continual customer satisfaction, the providers of banking services are now required to continually improve the quality of services. In this study, the researcher has made a study to determine the five dimension factors those have been followed in banks of Virudhunagar district and get the opinions from customers.

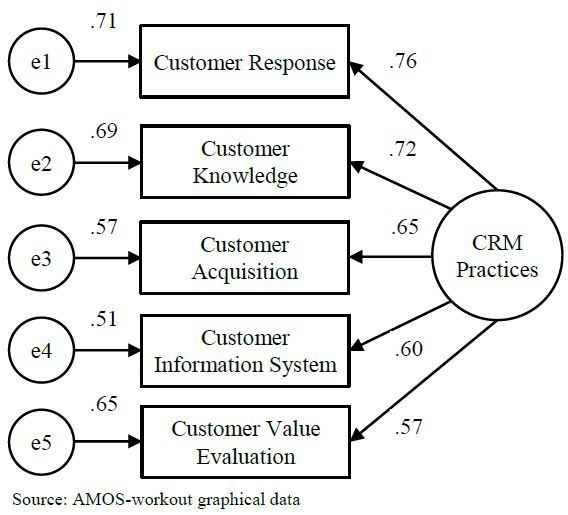

It is proposed that this paper analyze and frame the hypothesized model of CRM practices in banks and how the each dimensions accounted to the overall practice of CRM. It is presented in the following Fig.1.

3.1 CUSTOMER ACQUISITION

Customer acquisition is one of the processes of Relationship marketing, it bring new customers to the marketer. In bank-marketing more number of acquisitions oriented practices and initiatives followed to acquire the new customers. The primary purpose of acquisition based practices should handle with less consumption of time and cost. The customer acquisition initiatives should provide adequate requirements to the customers.

3.2 CUSTOMER RESPONSE

Customer response is the term used to describe and discuss, how the customer query and issues handled by the banks. If the bank deals the customer query in poor way it will result in dissatisfaction. So the bank should deal these receptive practices in an effective way. The impoverished customer response oriented practices working out through technologically and also the bank offers new type of services, schemes and it should intimated to the customer.

3.3 CUSTOMER KNOWLEDGE

Customer knowledge is essential one, who aims to adapt their processes, products and services to their customers' needs in order to build a healthy and profitable customer relationship. In this respect, the banking companies gather information and the insight they need to build stronger customer relationships. Their customer knowledge may not be sufficient and should set up the necessary processes and systems in order to collect more information and data on who are the customers are, what they do and how they think from the financial point of view.

3.4 CUSTOMER INFORMATION SYSTEM

A good CRM-Information system will help a business to attract, and win new customers, retain those the company already has, as well as reduce the costs of marketing and customer service. Thus in other sense a good customer information system provide adequate and complete information to the needy people. Complete information will leads to customer satisfaction. Customer information system in banks adopts recent innovative technologies to attract and systematic transparent information should be read out by the customers.

3.5 CUSTOMER VALUE EVALUATION

Customer value Evaluation is essential part of Customer Relationship Management dimension. The examination of customer value is not an easy task, it’s based on the method followed. Generally traditional method of evaluation process is very complex and difficult to execute it instead of modern evaluation process. The Modern evaluation process consist online survey, post and pre customer perceived value through product and services and so on. Moreover the bank should periodically conduct the customer audit meets to evaluate their customer service performance through the customer data.

4. OBJECTIVES OF THE STUDY

The objectives of the present study are as follows:

- Identify the factors more accounted for CRM practices.

- Confirm the hypothesized model of CRM practices in banks.

5. RESEARCH METHODOLOGY

This study is descriptive in nature and to examine the customer’s opinion about customer relationship management practices in banks. The data collected through self-administrated questionnaire to the banks customers who have account with public and private banks in Virudhunagar District. To get a high content validity the questionnaire distributed with local language. The demographic variables such as age, gender, income, education level, and savings are measured. The scale statement was adapted from the work of Lu and Shang [13] modified and suited to redefine the practices of banking sector. The opinion of customers towards CRM practices measured by using likert five point scaling techniques starts with 5-Strongly agree to 1- Strongly disagree. Multivariate statistical tools were applied to build and prove the researcher defined hypothesized model. In factor analysis structure deduction and confirmatory factor analysis is conducted.

In the first stage of analysis the researcher applies the factor analysis. The factor i.e. statements framed through strong theory behind the concept of CRM and its practices in banks. For simplicity and convenient purpose each factor (statements) re-coded with identifiable code viz. (Customer acquisition CA, Customer Knowledge CK like that,). Cronbach alpha test was applied to know the reliability and validity of the statement. Cronbach alpha values of 0.7 and greater is considered reliable, (Straub et al. [20]). The Cronbach alpha values for each component are greater than 0.7 and composite alpha value for five dimension is .879, thus indicating good reliability. To know the model fit, the KMO (Keiser-Meyer-Olkin) measures indicate the suitability of the data for structure deduction. If the KMO values high than 0.5 the data fits sampling adequacy. The present model comes with the value of KMO is .730 it is high than threshold value of 0.5. This is confirmed by the significant value yield by the test statistic Barlett test of Spheriscity. Chi- square = 1.592 df 300 P- 0.00 indicating that the variable related to the model and used to confirming author define hypothesized model. After the deduction, the pattern matrix values are used to apply the Confirmatory factor analysis in IBM-AMOS.

6. RESULTS AND DISCUSSION

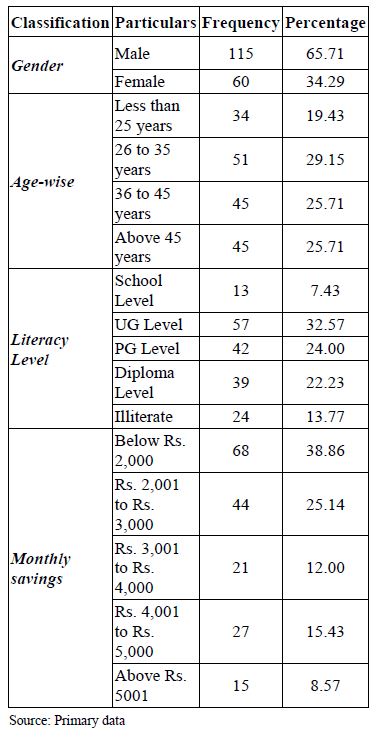

The demographic characteristics of the sample respondents have been presented in Table.1. As the result of Table.1 reveals, 65.71% of the respondents were male and 34.29% of them female. In total 29.15% of the respondents are in the age group of 26 to 35 years. The study shows total 32.57% of the sampled respondents are degree holders’ and 13.77 % of them illiterate; Out of the total respondents 38.86% of the respondents save below Rs. 2000 in month.

6.1 FACTOR ANALYSIS

Factor analysis is a data reduction technique that uses correlation between data variable. Factor analysis is widely used in psychology, social sciences and marketing studies. It assumes that some underlying factors exist that explains the correlation or interrelationship between the observed variable/factors. Analysis of the data in this study with the application of factor analysis, followed the approach used by Simon Gyasi Nimako [14]. That step consist Data reduction/structure deduction, Grouping the items and Confirmatory factor analysis and validity of the reduced dimensions. In general the factor analysis technique used in two ways, first one the researcher may reduce large number of variable from the data set within each factor and uses it for deducting the factor dimension.

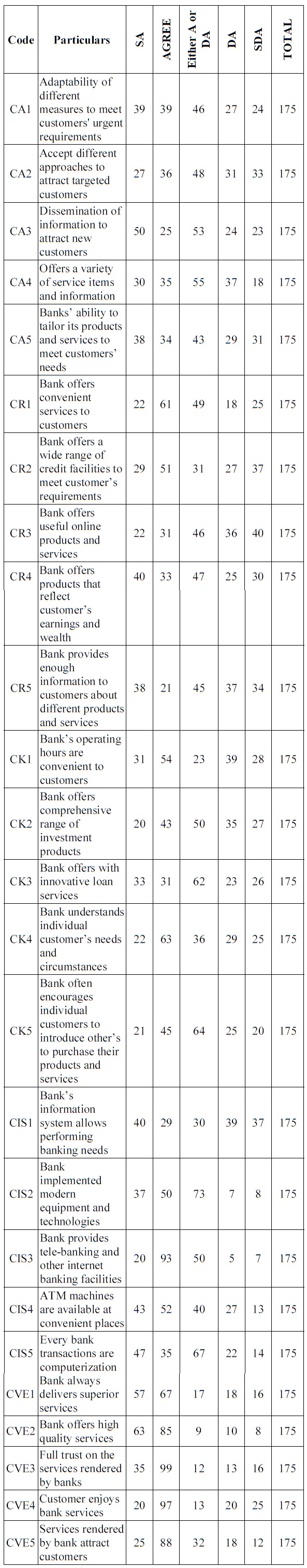

The Table.2 shows the opinion of customer towards CRM practices in five dimensions. In order to establish the strength of the factor analysis solution, it is essential to establish the reliability and validity of the obtained reduction. The result of KMO and Barlett’s test are given in Table.3.

It should be noted that the value of KMO statistics is greater than 0.5, indicating that factor analysis can be used for the given set of data. The present case the KMO value is greater than 0.5 (0.730>0.5). Therefore the given set of data fit for applying factor analysis. Further the bartlett’s test of sphericity is also shows significant result. The P value is less than assumed level significance (p<0.05). The result reveals the correlation matrix is significant for given set of data.

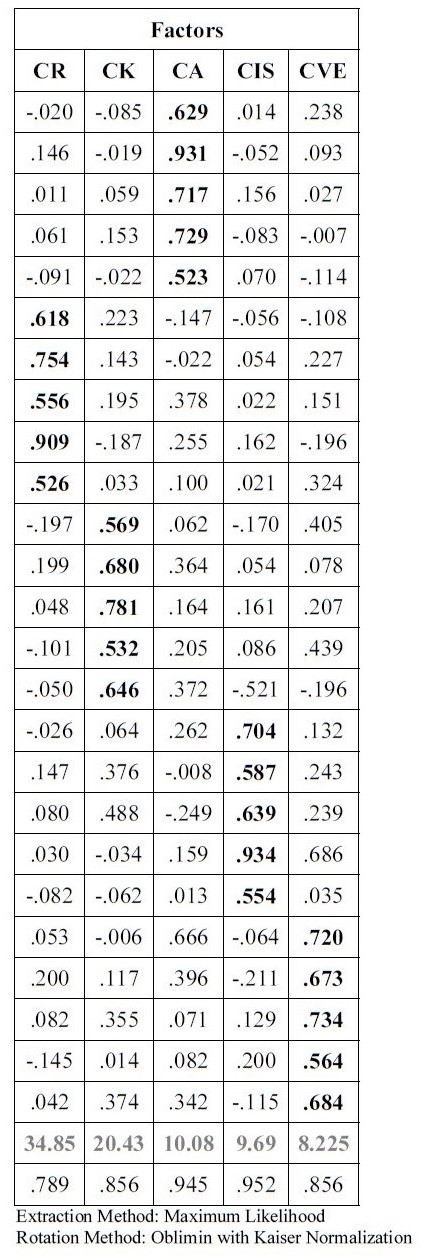

There are five factors extracted in the present model. The percentage of variance explained by each of the factor can be computed through Eigen values. As there are 25 variables, the total variance equals five. Therefore the variable explained by each factor can be computed as:

Percentage of variance explained by Factor 1

- = Eigen value of first factor / Sum total of the Eigen value*100

- = 8.714/25*100

- = 34.856

The other factor variance could be computed as above mentioned formula. The total variance explained by both factors = 34.856+20.430+10.086+9.695+8.225= 83.292%. In order to interpret the results, a cut-off point is decided. There is no hard and fast rule to decide the cut-off point, but generally it is taken above 0.5. The Table.4 shows the extracted pattern matrix of the model.

The total 83.292% of the variance is explained by five factors. The first factor (Customer response) Eigen value comes out 8.714 and 34.856% variance explained. The Customer knowledge is the second factor that explains 20.436% variance; the Customer acquisition is occupying the third factor with 10.086% of the variance explained; the remaining 9.695 and 8.225% of the variance explain followed by the Customer Information system and Customer value evaluation. All factors are high than the cut of score 0.5, so all the factors consider by the researcher to check and confirm the dimensions through confirmatory factor analysis in IBM-AMOS. The pattern matrix table used as input data for conducting the confirmatory factor analysis.

6.2 CONFIRMATORY FACTOR ANALYSIS

According to Diana Suhr [6], analyzing data and interpreting result is very complex and confusing. Traditional data analysis specifies default models assume measurement occurs without error, and are somewhat inflexible. However confirmatory factor analysis and SEM (Structural Equation Modeling) requires specification of a model based on theory and research, is a multivariate technique incorporating measured variables and latent constructs and explicitly specifies measurement error. A model allows for specification of relationship between variables. The user defined model valid is evaluated through some statistical criteria. Therefore determination criteria indicate acceptable fit while others are close to meet the acceptable fit value. First the model fulfill the criteria begins with the Chi-square statistic. Chi-square test describes differences of the observed and expected metrics. Acceptable model fit is, indicated by a chi-square probability value is close to zero or less than 0.05. RMSEA indicate the amount of unexplained variance or residuals. CFI, NNI and NFI values meet the criteria (0.90 or large) for acceptable model fit.

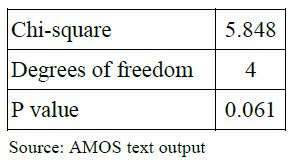

The Table.5 named Test of absolute fit indicated the chi-square values 5.848 with 4 degrees of freedom yield a probability value which is high than the critical value of 0.05. Suppose the P-value high than or equal to 0.05, the null hypothesis that the model fits the data. In the present case the P value is high than the critical value 0.05, therefore the researcher feel free to conclude the hypothesized model fits the data. The Goodness-of-fit-index (GFI) is a measure of the relative amount of variance and covariance in sample data that is jointly explained by the hypothesized data.

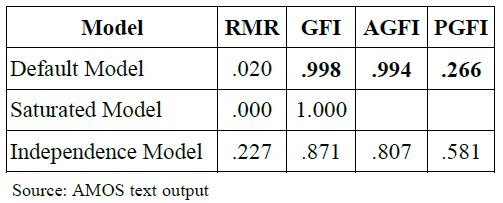

The Table.6 shows the GFI and AGFI output. The GFI and AGFI can be classified as absolute indices of fit because that basically compares the hypothesized model. Both criteria indicate the indices range from zero to one, close to 1.00 being a good fit. The present model works out data fitted to the model because value close to 1.

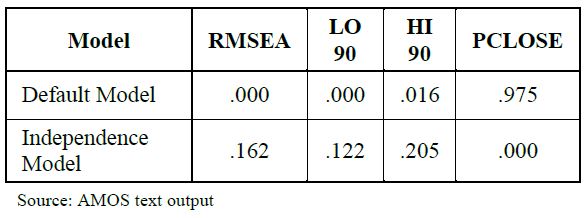

Finally the researcher will consider the statistic RMSEA (Root Mean Square Error of Approximation) this measure indicate the complexity of the model. Values high than 0.8, it returns reasonable error of approximation in the population. The values of the fit indices indicate a reasonable fit of the structural model with the sample data. In short the author defined altered model confirms the five –factor (Dimensions) structure of Customer relationship Management practices. The Table.7 indicates the results of RMSEA.The Fig.2 shows the five factor dimensions of Customer Relationship Management practices. The hypothesized model confirmed through CFA and Graphical workouts from IBM-AMOS. The values are standardized coefficients and beta value of observed variable. Lookout the Fig.2 error variance for the measured variables, shown on the left hand side of Fig.2, are simply 1 minus the value R2 shown in the AMOS diagram. R square measures the proportion of the variation in the dependent variable accounted by the explanatory variables. For example consider customer response R2 is .71 the error of measurement is 1-.71=.29. Among the five dimensions, Customer response highly influences the CRM practices followed by customer knowledge, customer value evaluation, customer acquisition and customer information system.

7. CONCLUSION

Every industry in India moves to product to customer centric approach, because customers are focal point. Higher profitability can be achieved through long-term relationship. The banking industry is not an exceptional case. Due to poor customer loyalty and arrival of new banks, also offering new services with higher service quality render by the banks to their customer. So retaining and maintaining of existing customer is very struggle to the bankers. For this there is higher need for the CRM in Banks. Banks have realized that customer relationships are a very important factor for their success. CRM impact on banking competitiveness as well as it provides a greater understanding of what constitutes a good CRM practices. The aim of this research is to develop and validate valid scale instrument to measure CRM practices in banks. The selected dimensions are employed and devised from the existing empirical study conducted in financial sector. Although the findings of the present study pinpoint the validated scales are statistically significant. Regarding this research work was conducted with small sample size, which is one of the limitations of this study. Huge and well clustered sample can be taken for the further enhancement and validation of this research work.

ACKNOWLEDGEMENT

Authors convey their sense of gratitude to the dignified management and dynamic principal of their college, for having provided with an excellent infrastructure to take the research, and for publishing articles. We are highly thankful to Ministry of Minority Affairs and University Grant Commission for financial support of this research.

REFERENCES

[1] Ajitah Dash and Soumendra Kumar Patra, “Service Quality as A key to Customer Satisfaction: An Assessment with Private Banks in Odisha”, European Journal of Commerce and Management Research, Vol. 2, No. 11, pp. 247-251, 2013.

[2] Mamoun N. Akroush, Samer E. Dahiyat, Hesham S. Gharaibeh and Bayan N. Abu‐Lail, “Customer Relationship Management Implementation: An Investigation of a Scale's Generalizability and its Relationship with Business Performance in a Developing Country Context”, International Journal of Commerce and Management, Vol. 21, No. 2, pp. 158-190, 2011.

[3] U. Zeynep Ata and Aysegul Toker, “The Effect of Customer Relationship Management Adoption in Business-to-Business Markets”, Journal of Business and Industrial Marketing, Vol. 27, No. 6, pp. 497-507, 2012.

[4] Roger Bennett, “Relationship Formation and Governance in Consumer Markets: Transactional Analysis versus the Behaviorist Approach”, Journal of Marketing Management, Vol. 12, No. 5, pp. 417-436, 1996.

[5] Ranjit Bose, “Customer Relationship Management: Key Components for IT success”, Industrial Management and Data Systems, Vol. 102, No. 2, pp. 89-97, 2002.

[6] Diana Suhr, “The Basis of Structural Equation Modeling”, Available at: lexjansen.com/tutorials/tut-suhr/pdf.

[7] Dilip B. Patil and Dinesh D. Bhakkad, “Redefining Management Practices and Marketing in Modern Age”, Athrar Publications, 2014. [8] David Gefen, “Customer Loyalty in E-Commerce”, Journal of the Association for Information Systems, Vol. 3, No. 1, pp. 27-51, 2002.

[9] Gisela Demo and Kesia Rozzett, “Customer Relationship Management Scale for the Business-to-Consumer Market: Validation in the United States and Comparison to Brazilian Models”, EnANPAD, Vol. 37, pp. 1-15, 2013.

[10] Calin Gurau, Ashok Ranchhod, and Ray Hackney, “Customer-Centric Strategic Planning: Integrating CRM in Online Business Systems”, Information Technology and Management, Vol. 4, No. 2, pp. 199-214, 2003.

[11] Mazhar Hussain, Iftikhar Hussain and Mushtaq A. Sajid, “Customer Relationship Management: Strategies and Practices in Selected Banks of Pakistan”, International Review of Business Research Papers, Vol. 5, No. 6, pp. 117-132, 2009.

[12] IzahMohd Tahir and ZulianaZulkifli, “A Preliminary Analysis of CRM Practices among Banks from the Customers’ Perspective”, Journal of Public Administration and Governance, Vol. 1, No. 1, pp. 274-285, 2011.

[13] Chin Shan Lu and Kuo Chung Shang, “An Evaluation of Customer Relationship Management in Freight Forwarder Services”, Proceedings of the 13th Asia Pacific Management Conference, pp. 1096- 1105, 2007.

[14] Simon Gyasi Nimako, Foresight Kofi Azumah, Francis Donkor and Veronica Adu-Brobbey, “Confirmatory Factor Analysis of Service Quality Dimensions within Mobile Telephony Industry in Ghana”, Electronic Journal Information Systems Evaluation, Vol. 15, No. 2, pp. 197-215, 2012.

[15] Nishikant Jha and Shraddha Mayursh Bhome, “A Study of CRM-As a Strategic Tool Adopted by Banks with Reference to Axis Bank in Thane City”, Indian Journal of Applied Research, Vol. 3, No. 5, pp. 454-457, 2013.

[16] C. Rootman, M. Tait and J. Bosch, “Variables Influencing the Customer Relationship Management of Banks”, Journal of Financial Services Marketing, Vol. 13, No. 1, pp. 52-62, 2008.

[17] S.B. Sachdev and H.V. Verma, “Relative Importance of Service Quality Dimensions: A Multi-Sectoral Study”, Journal of Services Research, Vol. 4, No. 1, pp. 93-116, 2004.

[18] Sanjay Kanti Das, “Bank Customer’s Perception Towards CRM Practices: Influence of Demographic Factors”, Journal of Business Management, Commerce & Research, Vol. 1, No. 1, pp. 1-15, 2012.

[19] N.S. Shibu. “Customer Relationship Management and Banking Industry”, Journal of Social Sciences, Vol. 36, No. 17, pp. 72-79, 2011. [20] D. Straub, M.-C. Boudreau and D. Gefen, “Validation Guidelines for IS Positivist Research”, Communications of the Association for Information Systems, Vol. 13, No. 1, pp. 380-427, 2004.

[21] Y. Wang, H.P. Lo, R. Chi and Y. Yang, “An Integrated Framework for Customer Value and Customer Relationship Management Performance: A Customer based Perspectives from China”, Managing Service Quality, Vol. 14, No. 2/3, pp. 169-182, 2004.

[22] S. Zhao, X. Cheng and W. Jiang, “Design and Implementation of Power Customer Value Evaluation System”, Proceedings of International Conference on Information Technology, Computer Engineering and Management Sciences, Vol. 4, pp. 16-20, 2011.