CORPORATE GOVERNANCE ISSUES, PRACTICES AND CONCERNS IN THE INDIAN CONTEXT – A CONCEPTUAL STUDY

Vidhu Shekhar Jha1 andVikas Mehra2

Department of Strategic Management and Marketing Management, Lal Bahadur Shastri Institute of Management, India

DOI: 10.21917/ijms.2015.0014

Abstract : This paper is a conceptual paper and is an attempt to make the concept of Corporate Governance understood in a very simple manner. The paper looks at the issues like how the concept of Corporate Governance is important in organizations, the objective of this concept, the performance expectation of all the stakeholders, and the need for corporate governance for Strategic Thinking and Strategy Implementation in an Organization. The mechanisms and controls, the impact of corporate governance on productivity for an organization and the recent research done in the Indian context is also looked in this paper. The various codes on corporate governance, which have evolved in India is also looked into in the paper. Implementation issues in the context of Indian companies are part of the paper. The role of corporate governance in Public Sector Enterprises (PSEs) and the role of the apex body for public sector enterprises in India, Standing Conference of Public Enterprises (SCOPE) are also highlighted in the paper. This is contrasted with existing corporate governance practices in the Private Sector operating in India.

Keywords: Corporate Governance, Public Sector & Private Sector in India, Strategy Implementation Issues and Corporate Governance Codes in India, Standing Conference of Public Enterprises (SCOPE), Tata Consultancy Services (TCS)1. INTRODUCTION

Corporate Governance refers to the relationship that exists between the different stakeholders for an organization, and defining the direction and performance of an organization or a corporate firm. The relevance of understanding of the issues and concerns and to have good corporate governance in letter and spirit has always been there for a sustained, sustainable growth for any organization. This issue has gained more importance, when we see many corporate scandals coming out in India as well as other parts of the world in recent past as those organizations did not apply good principles of corporate governance. The following bodies are the main actors in Corporate Governance.

1)The Chief Executive Officer, i.e. the top person in theorganization & the top management of the organization

2)The board of directors

3)The shareholders

The other actors who influence governance in corporations or firms are the employees, suppliers, customers, creditors and the community i.e. all the stake holders for the organization. A corporation can be defined as an instrument or a body by means of which capital is acquired, used for investing in assets producing goods and services, and their distribution (Prasad, Kesho, 2006) [1].

In simple words the essence of corporate governance is set of mechanisms used to manage the relationship among stakeholders and to determine and control the strategic direction and performance of organizations. At its core, corporate governance is concerned with identifying ways to ensure that strategic decisions are made effectively (Hitt et al., 2012) [2]. Fernando (2012) [3] gives the concept of what is Good Corporate Governance? He emphasizes that terms “Governance” and “Good Governance” are being increasingly used in development literature. Bad governance is being recognized now as one of the root causes of corrupt practices in our societies. He also emphasizes the company including its officers, including the board of directors and officials, especially the senior management, should strictly follow a code of conduct, which should have the obligation to society at large including the National interest, Political non-alignment, Legal compliances, Rule of law, Honest and Ethical Conduct, Corporate Citizenship, Social Concerns, Corporate Social Responsibility, Environment –Friendliness, Healthy and Safe working environment, HealthyCompetition, Trusteeship, Accountability, Effectiveness and efficiency, Timely responsiveness, and Corporations should uphold the fair name of the country.

This direction and subsequent performance will determine the success/failure of the organization. Hence the need to understand the issue of Corporate Governance is examined in the next section.

1.1 WHY THE ISSUE OF CORPORATE GOVERNANCE IS IMPORTANT?

The Corporate Governance reflects the company‟s values. Corporate governance has been emphasized in recent years because it has been shown in many companies worldwide, the governance mechanisms occasionally have failed to adequately monitor and control top-level mangers‟ decisions. Misangyi & Acharya (2014) [4] findings suggest that high profits result when CEO incentive alignment and monitoring mechanisms work together as complements rather than as substitutes. Furthermore, they show that high profits are obtained when both internal and external monitoring mechanisms are present. Their findings clearly suggest that the effectiveness of board independence and CEO non-duality--governance mechanisms widely believed to singularly resolve the agency problem--depends on how each combine with the other mechanisms in the governance bundle. This situation has resulted in changes in governance mechanisms in corporations throughout the world, especially with respect to efforts intended to improve the performance of boards of directors. Robert Monks (2005) [5], in his paper “Corporate Governance-USA-Fall 2004 Reform-The Wrong Way and the right Way”, concludes that almost there is a universal agreement that the Corporate Governance in America is failing. Andrea Georgescherer and Guiclo Palazzo (2011) [6] in their paper “The New Political Role of Business in Globalized World: A Review of New Perspective on CSR and its implications for the Firm, Government and Democracy”, conclude that under the conditions of globalization, the strict division of labor between private business and nation-state governance does not hold any more. Many businesses firms have started assuming social and political responsibilities that go beyond legal requirements and fill the regulatory vacuum in the global presence. A second and more positive reason for this interest is that evidence suggests that a well-functioning corporate governance and control system can create a competitive advantage for an individual firm. This is true for organizations worldwide including India.

1.2 OBJECTIVES OF CORPORATE GOVERNANCE

- To build up an environment of trust and confidence amongst those having competing and conflicting interest.

- To enhance the shareholders‟ value and protect the interest of other stakeholders by enhancing the corporate performance and accountability.

1.3 THE STAKEHOLDERS – AS HUMAN BEING IN BUSINESS

The stakeholders are the principal players in inception, sustainability, development and growth of any organization. They are shareholders, all employees of the company or organization, suppliers, customers, investors, banks, regulating agencies, government and community at large. All the means of production in an organization are utilized to create wealth for the community in general and stakeholders in particular. Everybody from supplier to customer, from investors to lenders, and from shareholders to stakeholders to the government is important in an organization. Manpower, Machinery and Money may travel from person to person, from place to place but the core of all the activities remains “People”. This is depicted in (Fig.1) that all stakeholders are human beings in business.

Tata Consultancy Services (TCS) has People embedded as one of the 3 Pillars of Corporate Sustainability (the other 2 Pillars being Planet & Profits). This is shown in (Fig.2) [8]. After 23 years, it has overtaken Reliance Industries Limited (RIL) to become India‟s most profitable corporate with net profit of Rs. 5,328 crores for quarter ending December 2014 (The Times of India, Jan 20, 2015) [9].

Fig.2. Corporate Sustainability of TCS (Source: Tata Consultancy Services: Corporate Sustainability Report 2013-14) [8]

PEOPLE: According to its Corporate Sustainability Report 2013-14, TCS has 300,464 employees. It conducts a wide range of CSR initiatives in the areas of education & skill building, health environment and affirmative action using volunteering, sponsorships and pro bono leveraging of its IT resources.

PLANET: TCS engages in sustainable green development along with its supply chain partners. It is continually engaged in reducing its energy, water, material and carbon footprint.

PROFITS: To ensure profits, it tries to ensure sustainable marketplace by working across industry verticals to provide next generation sustainable services to customers.

The performance expectations of stakeholders as per Parthasarthy (2007) [7] are given below in (Table.1):

What every human being needs in life is given below: Love: Relationship for communication of feelings and sharing resources. Inspiration: Motivation to live long and do great things. Fun: Feeling good all the time. Essentials: Food, clothing, shelter & health care. (Parthasarthy, 2007) [7]

2. NEED FOR GOOD CORPORATE GOVERNANCE

Research has shown that good corporate governance can lead to improved share price performance. There is evidence that there is a great potential for good performance by companies, which have got good corporate governance mechanism and the greatest benefit is in developing companies. Studies have indicated that investors are keener to invest in a better-governed company. Corporate Governance can be a very powerful tool for development especially in country like India.

The following issues are important for good Corporate Governance.

- The rights and obligation of shareholders.

- Equitable treatment of all stakeholders.

- The role of all stakeholders clearly defined and the linkage for corporate governance established.

- Transparency, disclosure of information and audit.

- The role of board of directors clearly defined.

- The role of non-executive members of the board clearly defined.

- Executive management and compensation and performance clearly defined.

2.1 MECHANISM AND CONTROL FOR CORPORATE GOVERNANCE

The mechanism and controls are designed to reduce the inefficiencies that arise from moral incongruities and adverse selection. Ethical diversion is a very important issue for Corporate Governance, while designing mechanism and control. The issues could be:

- Monitoring the Role/effectiveness of the Board of Directors.

- Remuneration of the Board Members and other employees in the company.

- Responsibilities and accountability for Audit Committees- financial reporting process, monitoring the choice of accounting policies and principles, monitoring internal control process and policy decisions for hiring and performance of the external auditors.

- Issues and concerns of Government Regulations

- Understand the strategic issues of the competition

- Management labour market and concerns of control mechanisms.

2.2 THE IMPACT OF CORPORATE GOVERNANCE ON PRODUCTIVITY AND THE CORPORATE SECTOR IN INDIA

In India, the idea of Corporate Governance is relatively new. Traditionally few researchers have written about it. Narayanaswamy, R. et al (2012) [10] provide a brief overview of corporate governance in India, including a description of Indian contextual differences (as compared to the U.S. and elsewhere) and a discussion of the major events contributing to the evolution of India's corporate governance/accounting/auditing practices since economic deregulation in 1991. They also offer an agenda for future research on important Indian governance/accounting/auditing issues, and briefly address accounting practice implications.

The Corporate sector operated generally on a philosophy of cost of production plus in the protected economy. Since they were not exposed to any serious competition, Indian industries continued with existing technologies and remained insensitive about technological developments and happening, but this trend is changing in many corporate houses in due course of the time and the companies in India some of them are becoming very much competitive and are harnessing technological, process and product innovation to become global players in their field. All such companies in India have given lot of importance to the issue of corporate governance.

Bhattacharya, CB. et al in McKinsey Report (2011) [11] talks about how companies can use Corporate Responsibility towards stakeholders as a conduit for furthering its goals. Ultimately stakeholders prefer companies which produce tangible and psychological benefits – which favor good Corporate Governance. Better governance reforms reduce uncertainty & are engines of stability and continued progress has helped Asian Corporate transform themselves during the period of globalization, as per report by Asian Productivity Organization, Tokyo in 2004 [12] [13].

The private corporate like the Tata Group, Aditya Birla Group, Infosys Technologies, Wipro Technologies, Godrej Group, Mahindra & Mahindra Group and Larson & Toubro (L&T.), of companies are giving a lot of importance to the issue of corporate governance. Some of them had understood this issue much better quite early, when they started their companies. Recently, Public sector companies in India, many of them, which have been, listed companies like Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation Ltd., Bharat Heavy Electricals Limited (BHEL), National Thermal Power Corporation (NTPC), Gas Authorities of India Limited (GAIL), Engineers India Limited (EIL), Gujarat Alkalies & Chemicals Ltd., Bharat Electronics Limited (BEL), and other such companies are applying the codes of good corporate governance for their organizations. The guidelines and codes have evolved over a period in India by Securities Exchange Board of India (SEBI) and various Committee setup by the Parliament to come up with the guidelines on corporate governance to Indian Companies. This part is looked in the next part of this paper

3. THE PROGRESS OF VARIOUS CODES OF GOVERNANCE WHICH HAVE EVOLVED IN INDIA ON THE ISSUES OF CORPORATE GOVERNANCE

As earlier explained in this paper, the topic of Corporate Governance is increasingly finding acceptance for its relevance and underlying importance in the industry and capital markets. Progressive firms in India have voluntarily put in place systems of good corporate governance since a long time ago. Internationally also, while this topic has been accepted for a long time, the financial crisis in emerging markets has led to renewed discussions and are focused on the issue of corporate governance. In view of the increasing realization of the importance of corporate governance, various reports have been prepared at different points of time in India to look at the issue of corporate governance in the organizations & are listed below:

3.1 IMPLEMENTATION, KEY ISSUES ON VARIOUS CODES OF GOVERNANCE FOR INDIAN COMPANIES

Shri Kumar Mangalam Birla Committee was constituted in May 1999 to promote and raise the standard of Corporate Governance in Indian Companies.

1) The mandatory recommendations of the Birla Committee (1999) are:

- Applies to all listed companies.

- Composition of Board of Directors: - Optimum combination of Executive and Non-Executive Directors

- Audit Committee: - With three independent Directors with one having financial and Accounting knowledge

- Issues pertaining to having a remuneration committee to look into the remuneration of the Chairman, Managing Director (Chief Executive Officer) Board Members & other executive and employees of the organization.

- Board Procedures:

- At least 4 meetings of the Board in a year with maximum gap of 4 months between two meetings. The meetings should review operational plans, capital budgets, quarterly results, and minutes of committee‟s meetings.

- A Director shall not be member of more than 10 committees and shall not act as chairman of more than 5 committees across all companies.

- Management discussion and Analysis report covering industry structure, opportunities, threats, risks, outlook, internal control system.

- Procedure & mechanisms for information sharing with shareholders.

2) Non-Mandatory Recommendations of Birla-Committee:

- The issues pertaining to:

- Role of Chairman, the Managing Director or the CEO

- Remuneration Committee of the Board

- Shareholders right for receiving half yearly Financial Performance

- Sale of whole or substantial part of the undertaking

- Corporate restructuring

- Venturing into new Business

3) Implementation of Recommendations of Birla Committee passed by the Indian Parliament.

4) By introduction of clauses 49 in the listing agreement with stock exchange. Provisions of clause – 49 are:

- Composition of Board-in case of full time Chairman, 50% Non-Executive Directors and 50% Executive Directors.

- Constituting of Audit Committee – with 3 independent directors with Chairman having sound Financial Background, Finance Directors and internal Audit head to be special invitees and minimum of 3 meetings to be convened.

- Responsible for review of financial performance on half yearly/ annually basis/ appointment / removal / remuneration of auditors, review of internal control systems and its adequacy.

- Remuneration of Directors: - Remuneration of non-executive Directors to be decided by the board. Details of remuneration package, stock options, performance incentives of Directors to be disclosed.

- Board Procedures: - At least 4 meetings in a year. Director not to be member of more than 10 committees and chairman of more than 5 committees across all companies.

- Management discussion & analysis report should include:

- Industry structure & Developments

- Opportunities & Threats

- Segment-wise or product-wise performance reports

- Outlook of the industry and the organization

- Risks and concerns for the organization

- Internal control systems & its adequacy

- Discussion on Financial performance

- Disclosure by directors on material, financial and commercial transactions with the company.

- Shareholder‟s Information: - Brief resume of new/re-appointed Directors, Quarterly results to be submitted to stock exchanges and to be placed on web site, presentation to analysis.

- Shareholders/Investors Grievance committee under the chairmanship of independent Director minimum 2 meetings in a year.

- Report on Corporate Governance and certificate from auditors on compliance of provisions of corporate governance as per clause – 49 in the listing agreement.

3.2 RECENT DEVELOPMENT ON THE CODES FOR CORPORATE GOVERNANCE FOR INDIAN COMPANIES

- A committee headed by Shri Naresh Chandra was constituted August 2002 to examine corporate audit, role of auditors, relationship of company & auditor.

- The key recommendations of the Naresh Chandra Committee are given below:

- Recommended a list of disqualifications for Audit Assignments like Direct Relationship with company, any Business relationship with the client, and personnel relationship with the directors of the board.

- Audit firms not provide services such as accounting, internal audit assignments etc. to audit clients.

- Audit to disclose contingent liabilities & highlight significant accounting Policies.

- Audit Committee to be first point of reference for appointment of auditors.

- Chief Executive Officer (CEO) and Chief Financial Officer (CFO) of listed company to certify on fairness, corrections of annual audited accounts.

- Redefinitions of independent Directors- Does not have any material relationship with the company

- Composition of Board of Directors

- Statutory limit on the sitting fee to non-executive Directors to be reviewed.

These recommendations now have been formed part of companies (Amendment) Bill, 2003 by the Parliament of India.

- Securities Exchange Board of India (SEBI) constituted a committee headed by Shri N.R.Narayana Murthy to review existing code of corporate Governance. The major recommendations were:

- Strengthening the responsibilities of Audit Committee

- Improving the quality of Financial Disclosures

- Utilizations of proceeds from IPO

- To assess and disclose Business risk

- Whistle Blower policy to be in place in a company providing Freedom to approach the Audit Committee

- Subsidiaries to be reviewed by Audit Committee of the holding company.

- Companies Act 2013 (CA 2013) [14], which has replaced the Companies Act 1956 (CA 1956), has brought in some significant changes in Corporate Governance standards, including:

CA 2013 requires companies to have following classes of Directors as shown in Fig.3.

Resident Director is a person who has stayed in India not less than 182 days in the previous calendar year. CA 1956 did not require appointment of Independent directors; CA 2013 makes it mandatory in line with Clause 49 of Listing Agreement with Stock Exchange, along with making it mandatory to have at least 1 Woman board director.

Company Act 2013 (CA 2013) [14] obligates the board to constitute the following 4 committees as shown in Fig.4.

CA 2013 has introduced key changes w.r.t. board meetings and processes. It permits directors to participate via audio visual means such as video conferencing, which recognizes the technological advances in communication globally.

3.3 SOME RECENT RESEARCH WORK ON CORPORATE GOVERNANCE IN THE CONTEXT OF INDIA

Prasad (2014) [15] commented that Indian corporate governance still leaves much to be desired. Starting from 1980s, India opened up its economy and is making all efforts to attract foreign direct investment. However the high-profile corporate failures, which seem to be recurring at regular intervals during last three decades, the latest one being Satyam computers exposed the weaknesses and insufficiency of corporate governance practices in India. Ineffective corporate governance can scare away both domestic and the foreign investors and can be detrimental to the economic growth of the country. The Indian government, fully aware of this fact, is trying to put in place an effective legal and regulatory frame work in order to improve the corporate governance. Prasad (2014) concludes that its major weakness lies in the implementation.

In his paper, Bhalla (2012) [16] has tried to find out the perception of different level of executives about corporate governance in India. Different Private and Public companies of India are compared and tried to examine if there is any relation between the performance of the companies and satisfaction of the investors in lieu of good governance practices in India.

Tuteja (2006) [17] has studied the structuring of the Board as an important issue for corporate governance. He has analyzed the prevailing corporate management structure by studying the data of 100 companies operating in India. His study finds that there is a marked shift in favor of management by chief executive officer/whole time directors under the guidance of the Board of Directors. More and more companies irrespective of their year of incorporation or capital, operating in India are opting for this system after the liberalization because, first, the law requires companies with a paid-up capital of more than Rs. 5 crores to have a chief-executive officers and majority of companies today fall under this category. Liberalization in India seems to have an influence over the appointment of executive or whole-time directors. Company boards, however, are still dominated by non-executive directors especially due to the new rules relating to audit committees, and also due to requirements of appointment of independent directors by companies. Tuteja (2006) [17] argues that corporate directorships in India are undergoing a sea change both quantitative and qualitative terms, due to ongoing liberalization process.

Dwivedi and Jain (2005) [18] have also looked into corporate governance parameters including board size, director‟s shareholders, and institutional and foreign shareholding. They have looked at 340 large, listed Indian firms from the period of 1997-2001 across industry groups.

Desai (2000) [19] has talked about “A beginning of Corporate Governance, the Companies (Second Amendment) Bill 1999 looks the issue of corporate governance in general in India at that point of time, the importance of company secretaries to ensure compliance by small companies, the Directors responsibilities in a Board of a company, the role of SEBI in the jurisdiction and control over companies, the guidelines on the companies to have minimum capital and Amendments concerning the auditors.

We will look at some of the issues related to corporate governance and the organizational related to understand the issues and concerns for corporate governance in India especially the Public Sector Enterprises (PSEs) in India in the next section of this paper.

4. CENTRE FOR CORPORATE GOVERNANCE – AND THE WORLD COUNCIL FOR CORPORATE GOVERNANCE

The Centre for Corporate Governance was established in Institute of Directors (India) with a view as to galvanizing good governance practices in corporate bodies affiliated to the World Council for Corporate Governance, part of World Bank group. Governance is concerned with empowering people, spurring and pursuing innovation and improving issues, which address conflict of interest, which can impose burdens on the enterprise. Ensuring transparency in corporate affairs can make a major contribution to improving business standards as explained in the early part of the paper.

There are other bodies like National Foundation for Corporate Governance in India (NFCG), which are organizing events/conferences or Corporate Governance trends issues and concerns in India with the help of the Govt. of India and confederation of India Industry (CII), also taking help from the World Bank Body called the World Council for Corporate Governance.

Dr. Y.R.K Reddy, Chairman, Yaga Consulting Pvt. Ltd. in India, has been researching a corporate governance with special emphasis on public enterprises and Banking (Reddy, Y.R.K. 2009) [20].

The next part of the paper will look at the Role of the Standing Conference of Public Enterprises (SCOPE) based in New Delhi and its concerns and evaluation of Good Corporate Governance in listed Public Sector Companies in India.

4.1 STANDING CONFERENCE OF PUBLIC ENTERPRISES (SCOPE), NEW DELHI & THE CONCERN FOR CORPORATE GOVERNANCE

The Standing Conference of Public Enterprises (SCOPE), New Delhi had recognized in 1996 the need for Corporate Governance issues relevant to public sector undertakings in India i.e. those companies in India, where the Indian Government has equity of 51% and above. SCOPE is an apex professional organization representing the central/state public enterprises, banks and other institutions. Its mission is to promote excellence in organizations, where public investments in involved.

SCOPE is the apex body of Central Government owned Public Enterprises [21]. SCOPE has all the central public enterprises, a few state government enterprises and some nationalized banks as its members.

The Prime Minister of India, Dr. Manmohan Singh on March 8, 2007 in New Delhi, while giving away SCOPE AWARD for 2005-2006 [22] and inaugurating, suggested that the Central Government would like more Public Sector Enterprises (PSEs) to go public. “It may be useful for more public enterprises to be listed on the stock exchange, as this would enhance professionalism of the board of directors and empower the independent directors stressed the need for good Corporate Governance among the Indian PSEs”. (Table.2 gives a list of companies getting the SCOPE Awards for Corporate Governance in recent years.).

Many private companies like Tata Steel, Tata Motors and other companies in the house of Tatas, Dr. Reddy Labs, Infosys Technologies, Wipro Technologies and others have understood the need of good Corporate Governance for sustainability for quite some time and evolved their organization on the codes of good Corporate Governance.

Bhalla (2012) [13] found in his study that the corporate governance practices of both public sector and private sector companies are almost similar. However, she found that there are greater political and bureaucratic influences in public sector versus private sector.

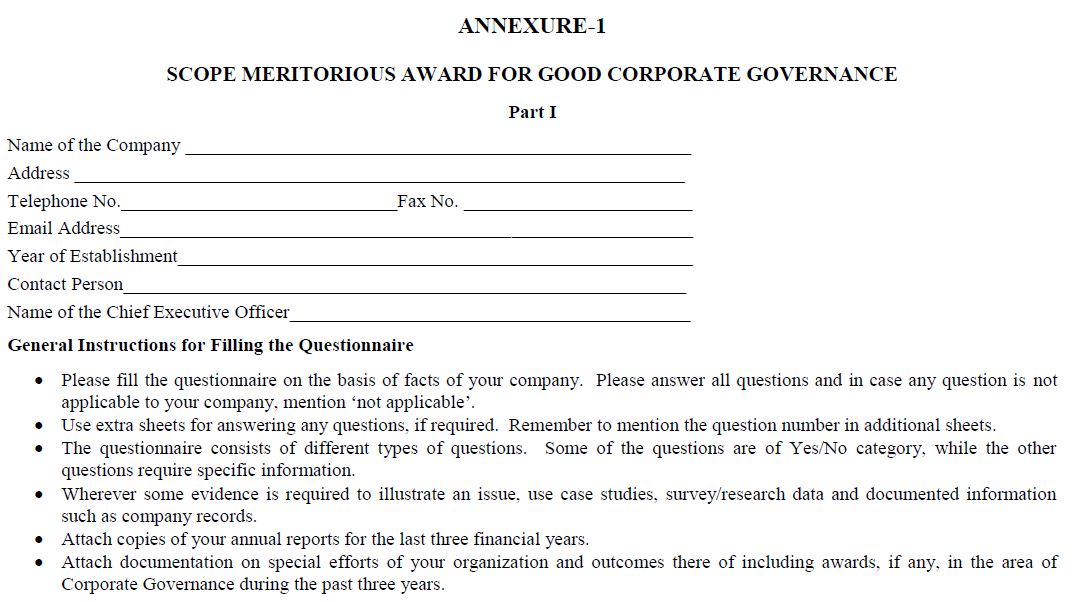

Public Sector Enterprises in India (PSEs), some of them also now figure in Fortune 500 Companies. The PSEs in India like Indian Oil Corporation Limited (IOCL), National Thermal Power Corporation (NTPC), Oil and Natural Gas Corporation (ONGC), Bharat Heavy Electrical (BHEL), Steel Authority of India Ltd (SAIL), Gas Authority of India Ltd. (GAIL), Gujarat Alkalies and Chemicals Ltd., Bharat Electronics Ltd (BEL), Power Grid Corporation, Fertilizer Corporation of India Ltd. have been trying to improve the Corporate Governance in their organizations for moving toward Business Excellence and gain competitive advantage and sustainability in their industries for quite some time now. (The checklist and a format used for application for SCOPE meritorious award for Corporate Governance are given in Annexure – I of this paper) [22].

The PSEs and other companies in India understand the importance of Corporate Governance and institutionalized systems and procedures on issue of ethics, transparency, code of conduct of the Board Members, the Audit Committee, and other related mechanisms of control for good Corporate Governance for better strategy implementation and taking their companies towards excellence.

5. THE EFFECTIVENESS AND TOTAL BOARD PERFORMANCE AND CORPORATE GOVERNANCE AS A STRATEGIC TOOL FOR STRATEGY IMPLEMENTATION

The effectiveness and total board performance depends on the strategic thinking by the board, a very important issue in Corporate Governance. This can be illustrated in Fig.5 given below through an adapted model on strategic thinking.

5.1 THE DIRECTORIAL DASHBOARD

6. CONCLUSION

This paper addresses some of the issues and concerns faced by Indian companies on the issues of Corporate Governance. Due to emergence of vibrant corporate sector post 1991 liberalization, all the developments related to Corporate Governance have occurred after this period. SCOPE is playing an important regulatory role for Public Sector Enterprises (PSEs). Certain large private sectors corporate, such as TCS, are doing credible work in this area. Periodic government intervention, like enactment of Clause 49 & Company Act 2013 (which has replaced Company Act 1956), is also contributing to both private & public sector enhancing corporate governance standards.

If one has to summarize, the ultimate objective of corporate governance is to attain the highest standard of procedures and practices followed by corporate world so as to have transparency in its functioning with an ultimate aim to maximize the value of various stakeholders of the organization. The issue of understanding and application of Corporate Governance in letter and spirit is very important for any organization to be successful and competitive in the long run.

REFERENCES

[1] Prasad, Kesho, “Corporate Governance”, Prentice Hall: New Delhi, 2006.

[2] Michael A. Hitt, R. Duane Ireland, Robert E. Hoskisson and S. Manikutty, “Strategic Management: South Asian Perspective”, 9th Edition, Cengage Learning India, 2012.

[3] A. C. Fernando, “Business Ethics and Corporate Governance”, Second Edition, Pearson, 2012.

[4] Vilmos F. Misangyi and Abhijith G. Acharya, “Substitutes or Compliments? A Configurational Examination of Corporate Governance Mechanisms”, Academy of Management Journal, Vol. 57, No. 6, pp. 1681-1705, 2014.

[5] Robert A. G. Monks, “Corporate Governance-USA-Fall- 2004 Reform-The Wrong Way & The Right Way”, Corporate Governance: An International Review, Vol. 13, No. 2, pp 108-113, 2005.

[6] Andreas Georg Scherer and Guido Palazzo, “The New Political Role of Business in a Globalized World: A Review of New Perspective on CSR and Its implications for the Firm, Government and Democracy”, Journal of Management Studies, Vol. 48, No. 4, pp. 899-931, 2011.

[7] Swami Parthasarthy, “Corporate Governance, Principles, Mechanisms & Practice”, Indian Text Edition, Biztantra Publications, 2007.

[8] Corporate Sustainability Report 2013-14. Available at www.tcs.com, Accessed 10 January 2015.

[9] TCS overtakes RIL as most profitable firm. Available at www.indiainfoline.com. Accessed 21 January 2015.

[10] R. Narayanaswamy, K. Raghunandan and Dasaratha V. Rama, “Corporate Governance in the Indian Context, Accounting Horizons”, Vol. 26, No. 3, pp. 583-599, 2012.

[11] C. B. Bhattacharya, Daniel Korschun and Sankar Sen, “What really drives value in Corporate Responsibility?”, McKinsey Report, 2011.

[12] R. C. Monga, “National Productivity Council, India”, The Impact of Corporate Governance on Productivity in India, Impact of Corporate Governance on Productivity, pp. 111-143, 2004.

[13] Eduardo T. Gonzalez, “Impact of Corporate Governance on Productivity: Asian Experience”, Asian Productivity Organization: Tokyo, 2004.

[14] Companies Act 2013, Available at www.sebi.gov.in, Accessed 26 December 2014.

[15] Siva Prasad Ravi, “Corporate Governance in India: Challenges for Emerging Economic Super Power”, Business Studies Journal, Supplement 2, Vol. 6, pp. 1-17, 2014.

[16] Jaya Bhalla, “Corporate Governance: Perception of Executives in India”, Review of Management, Vol. 2, No. 1/2, pp. 35-43, 2012.

[17] S. K. Tuteja, “Board Structure in Indian Companies – An empirical survey”, Journal of Management Research, Vol. 6, No. 3, pp. 149-155, 2006.

[18] Neeraj Dwivedi and Arun Kumar Jain, “Corporate Governance and performance of Indian Firms: The effect of Board Size and Ownership”, Employee Responsibilities and Rights Journal, Vol. 17, No. 3, pp. 161-171, 2005.

[19] Suresh Thakur Desai, “A beginning of Corporate Governance” Chemical Business, Vol. 14, No. 2, pp. 42-44, 2000.

[20] Y. R. K. Reddy, “The ethics of corporate governance: An Asian perspective”, International Journal of Law and Management, Vol. 51, No. 1, pp. 17-26, 2009.

[21] SCOPE an apex organization involved in promoting Public Sectors in India. Available at www.indiapublicsector.com/scope.questions. Accessed 10 November 2014.

[22] Scope meritorious award for good Corporate Governance. Available at www.scopeonline.in. Accessed 10 November 2014.